will the salt tax be repealed

Store or Microsoft Store means a Microsoft owned or operated platform including any services that allow users to access content from the platform however. Many different groups lobbied and rallied under the name of the Temperance Movement until the 18th Amendment was passed in January of 1920.

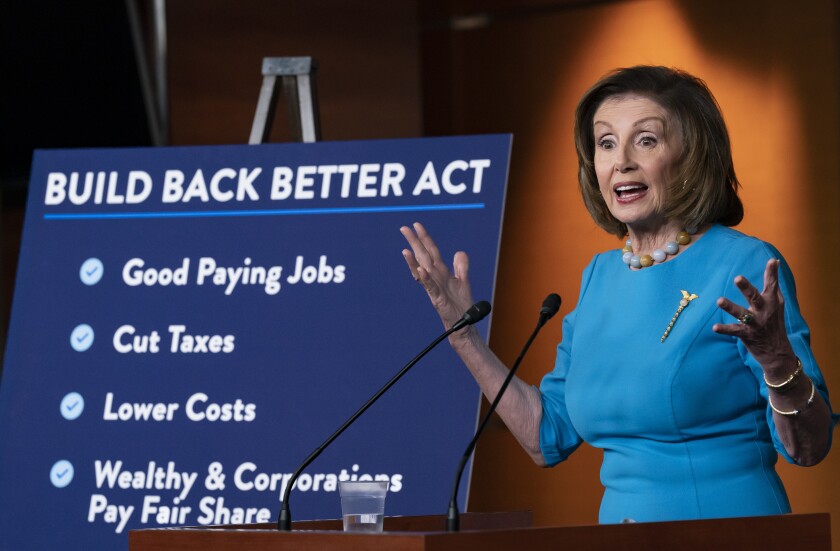

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Gandhis Salt March 1930.

. E of this section concerning imported salt used in curing fish superseded somewhat similar provisions in RS. The Act is also amended to provide for the refund of overpayments of tax paid under the Act in specified circumstances. The amount of tax payable by an estate whose value exceeds 50000 is 15 for each 1000 or part thereof by which its value exceeds 50000.

Implementation of SALT Charitable Contribution Law. Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined. Exemption for certain.

A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. Took money out of his own pocketmortgaging a family farm that he owned outrightto tool up new models and he tirelessly lobbied lawmakers anywhere that he could get a meeting with them until the luxury tax was repealed 20 long months later in 1993. - 1 In General.

An estate whose value is 50000 or less is exempt from tax under the Act. Ccc water-softener salt when purchased by a municipality or local government district for mixing with water for its own use or for the sale of water to its residents. The tax election is automatically repealed on December 1 2026.

Repealed - superseded by Local Finance Notice 2022-11. It was repealed in 1648 as the legislature. The provisions of subsec.

Individuals and corporations are directly taxable and estates and trusts may be taxable on. If mailing a refund or no payment return mail to the Office of Tax and Revenue PO Box 96145 Washington DC 20090-6145. The Prohibition lasted for about 23 years until it was repealed by the 21st Amendment in 1933- which you can thank Anti-Prohibition protestors for.

In addition should the SALT cap be repealed before December 1 2026 the California PTE tax election becomes inoperative for taxable years beginning on or after the January 1 after the federal repeal and shall be repealed December 1 of that taxable year. Salt was exempted from most duties as it was an important ingredient in the preservation of codfish an important export. D Capital Gains from Sale of Real Property.

The low-tax beginnings of. Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight.

New Required Tax Bill Language on Property Tax Relief Programs. By then Vikings staff had been slashed from 1500 to 65 souls. The mailing address for the D-40 individual income tax returns is Office of Tax and Revenue PO Box 96169 Washington DC 20090-6169.

CY2019SFY2020 Best Practices Inventory. However the tax on livestock was short-lived. Standard Application License Terms or SALT means the Customer license agreement made available by Microsoft as set forth in Exhibit G or another location specified by Microsoft.

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. ARP Funding Planning Evidence Equity Considerations. Though Tennessee used to tax investment income and interest the Hall income tax was fully repealed on Jan.

3022 which was repealed by act Sept. 356 title IV 642 42 Stat. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California.

Plymouth placed export duties on such products as boards barrel staves tar oysters and iron. Xx1 mine mining processing and mineral product have the same meaning as in The Mining Tax Act. - The provisions of Section 39B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in accordance with Section 6E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized from the sale exchange or.

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

How To Build A Fun Family Time Capsule Time Capsule Family Fun Time Time Capsule Kids

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

This Bill Could Give You A 60 000 Tax Deduction

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

A Complicated Equation State And Local Tax Proposals And The Salt Deduction Northern Trust

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Green Monstah Poultry Vegetables Popcorn Dry Cough Remedies Nutrition Healthy Eating Wide Mouth Glass Jars

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Green Monstah Poultry Vegetables Popcorn Dry Cough Remedies Nutrition Healthy Eating Wide Mouth Glass Jars